[42]:

from hestonpy.models.bates import Bates

import matplotlib.pyplot as plt

import time

import numpy as np

Pricing with Bates#

Initialisation of the model#

[52]:

S0 = 100

V0 = 0.06

r = 0.05

params = {

"kappa": 1,

"theta": 0.06,

"sigma": 0.3,

"rho": -0.5,

'lambda_jump': 4.5,

'mu_J': 0.00,

'sigma_J': 0.05,

"drift_emm": 0.00,

}

bates = Bates(spot=S0, vol_initial=V0, r=r, **params)

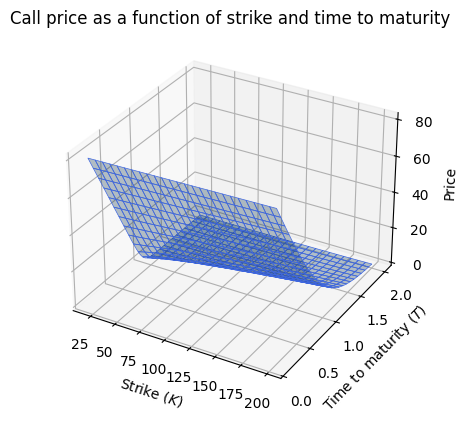

[53]:

bates.price_surface()

Price via Monte Carlo#

Parameters

[54]:

nbr_points = 100

nbr_simulations = 10**3

Via Euler-Maruyama scheme

[55]:

start_time = time.time()

result = bates.monte_carlo_price(nbr_points=nbr_points, nbr_simulations=nbr_simulations, strike=100, time_to_maturity=1, scheme="euler")

time_delta = round(time.time() - start_time,4)

price_euler = round(result.price, 2)

std_euler = round(result.std, 2)

infinum_euler = round(result.infinum, 2)

supremum_euler = round(result.supremum, 2)

print(f"Monte Carlo Euler scheme in {time_delta}s : price ${price_euler}, std {std_euler}, and Confidence interval [{infinum_euler},{supremum_euler}]\n")

Variance has been null 0 times over the 100000 iterations (0.0%)

Monte Carlo Euler scheme in 0.0637s : price $13.83, std 0.58, and Confidence interval [13.78,13.88]

Via Milstein scheme

[56]:

start_time = time.time()

result = bates.monte_carlo_price(nbr_points=nbr_points, nbr_simulations=nbr_simulations, strike=100, time_to_maturity=1, scheme="milstein")

time_delta = round(time.time() - start_time,4)

price_milstein = round(result.price, 2)

std_milstein = round(result.std, 2)

infinum_milstein = round(result.infinum, 2)

supremum_milstein = round(result.supremum, 2)

print(f"Monte Carlo Milstein scheme in {time_delta}s : price ${price_milstein}, std {std_milstein}, and Confidence interval [{infinum_milstein},{supremum_milstein}]\n")

Variance has been null 0 times over the 100000 iterations (0.0%)

Monte Carlo Milstein scheme in 0.0552s : price $13.17, std 0.57, and Confidence interval [13.13,13.22]

Price via Carr-Madan formula#

[57]:

start_time = time.time()

price_CM, error_CM = bates.carr_madan_price(strike=100, time_to_maturity=1, error_boolean=True)

time_delta = round(time.time() - start_time,4)

infinum = round(price_CM-error_CM, 3)

supremum = round(price_CM+error_CM, 3)

price_CM = round(price_CM, 3)

error_CM = round(error_CM, 14)

print(f"Carr-Madan in {time_delta}s : price ${price_CM}, error ${error_CM} , and Confidence interval [{infinum},{supremum}]\n")

Carr-Madan in 0.1314s : price $12.779, error $1.4462e-10 , and Confidence interval [12.779,12.779]

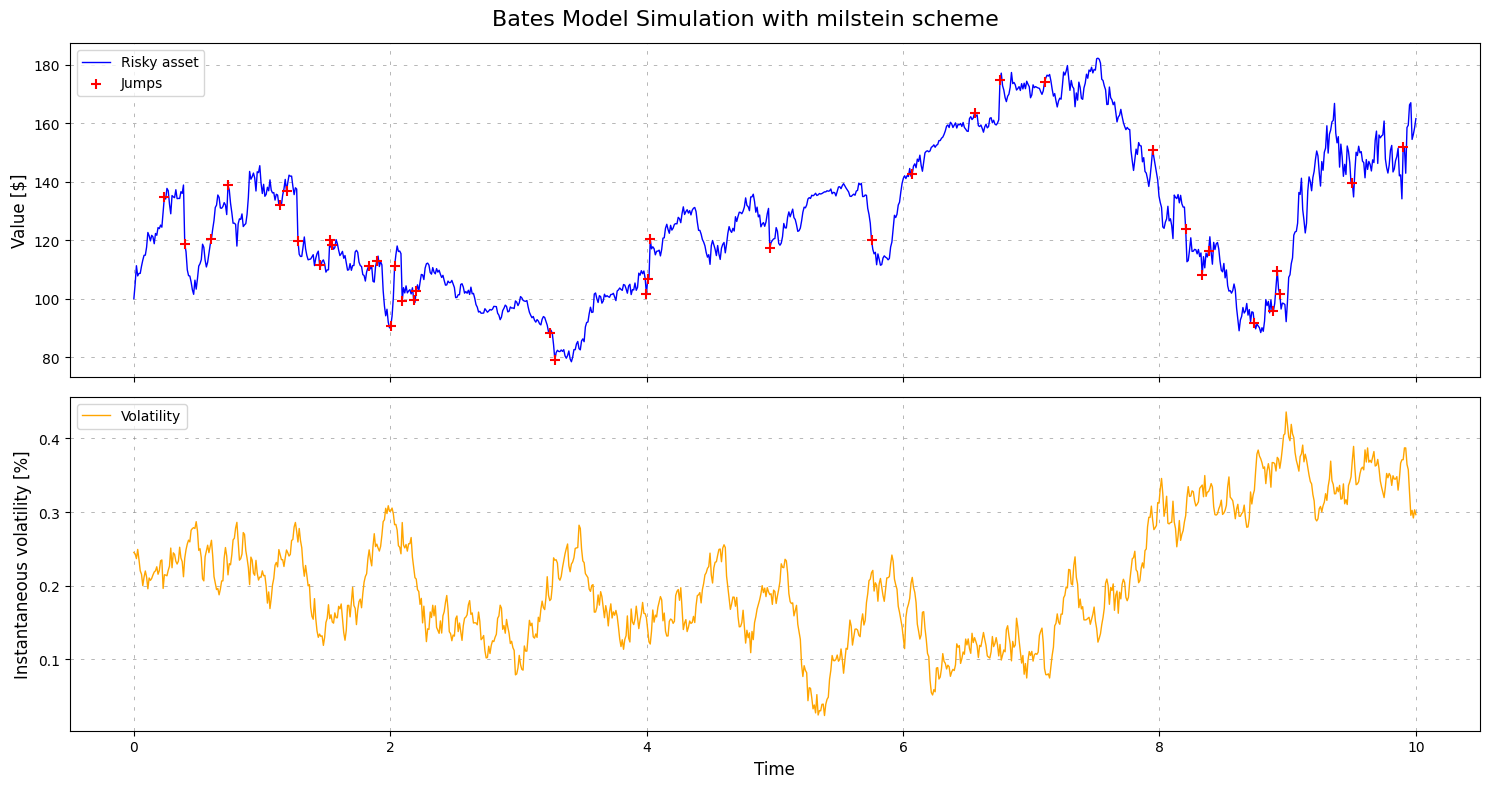

Path simulations#

[58]:

scheme = 'milstein'

_ = bates.plot_simulation(time_to_maturity=10, scheme=scheme, nbr_points=252*4)