[5]:

from hestonpy.models.heston import Heston

from hestonpy.models.bates import Bates

from hestonpy.models.calibration.volatilitySmile import VolatilitySmile

r = 0.00

Calibration on market data#

Get market data

[6]:

from hestonpy.option.data import get_options_data, filter_data_for_maturity

symbol='^SPX'

all_market_data, spot, maturities = get_options_data(symbol=symbol)

spot

[6]:

np.float64(5396.52001953125)

Choose your smile/maturity

[7]:

maturities

[7]:

('2025-04-04',

'2025-04-07',

'2025-04-08',

'2025-04-09',

'2025-04-10',

'2025-04-11',

'2025-04-14',

'2025-04-15',

'2025-04-16',

'2025-04-17',

'2025-04-21',

'2025-04-22',

'2025-04-23',

'2025-04-24',

'2025-04-25',

'2025-04-28',

'2025-04-29',

'2025-04-30',

'2025-05-01',

'2025-05-02',

'2025-05-05',

'2025-05-06',

'2025-05-08',

'2025-05-09',

'2025-05-16',

'2025-05-30',

'2025-06-20',

'2025-06-30',

'2025-07-18',

'2025-07-31',

'2025-08-15',

'2025-08-29',

'2025-09-19',

'2025-09-30',

'2025-10-17',

'2025-11-21',

'2025-12-19',

'2025-12-31',

'2026-01-16',

'2026-02-20',

'2026-03-20',

'2026-03-31',

'2026-04-17',

'2026-06-18',

'2026-12-18',

'2027-12-17',

'2028-12-15',

'2029-12-21',

'2030-12-20')

[8]:

maturity = maturities[28]

full_market_data = filter_data_for_maturity(all_market_data, maturity)

full_market_data.head()

[8]:

| Call Price | Bid | Ask | Implied Volatility | Strike | Volume | Time to Maturity | Maturity | |

|---|---|---|---|---|---|---|---|---|

| 0 | 5357.61 | 5133.6 | 5145.5 | 0.000010 | 200.0 | 1.0 | 0.297619 | 2025-07-18 |

| 1 | 5062.65 | 5188.8 | 5206.3 | 5.966830 | 800.0 | 2.0 | 0.297619 | 2025-07-18 |

| 2 | 4589.30 | 4345.0 | 4362.7 | 0.000010 | 1000.0 | 1.0 | 0.297619 | 2025-07-18 |

| 3 | 4676.42 | 4797.4 | 4815.3 | 4.155095 | 1200.0 | 18.0 | 0.297619 | 2025-07-18 |

| 4 | 4500.20 | 4605.1 | 4620.0 | 3.680169 | 1400.0 | 1.0 | 0.297619 | 2025-07-18 |

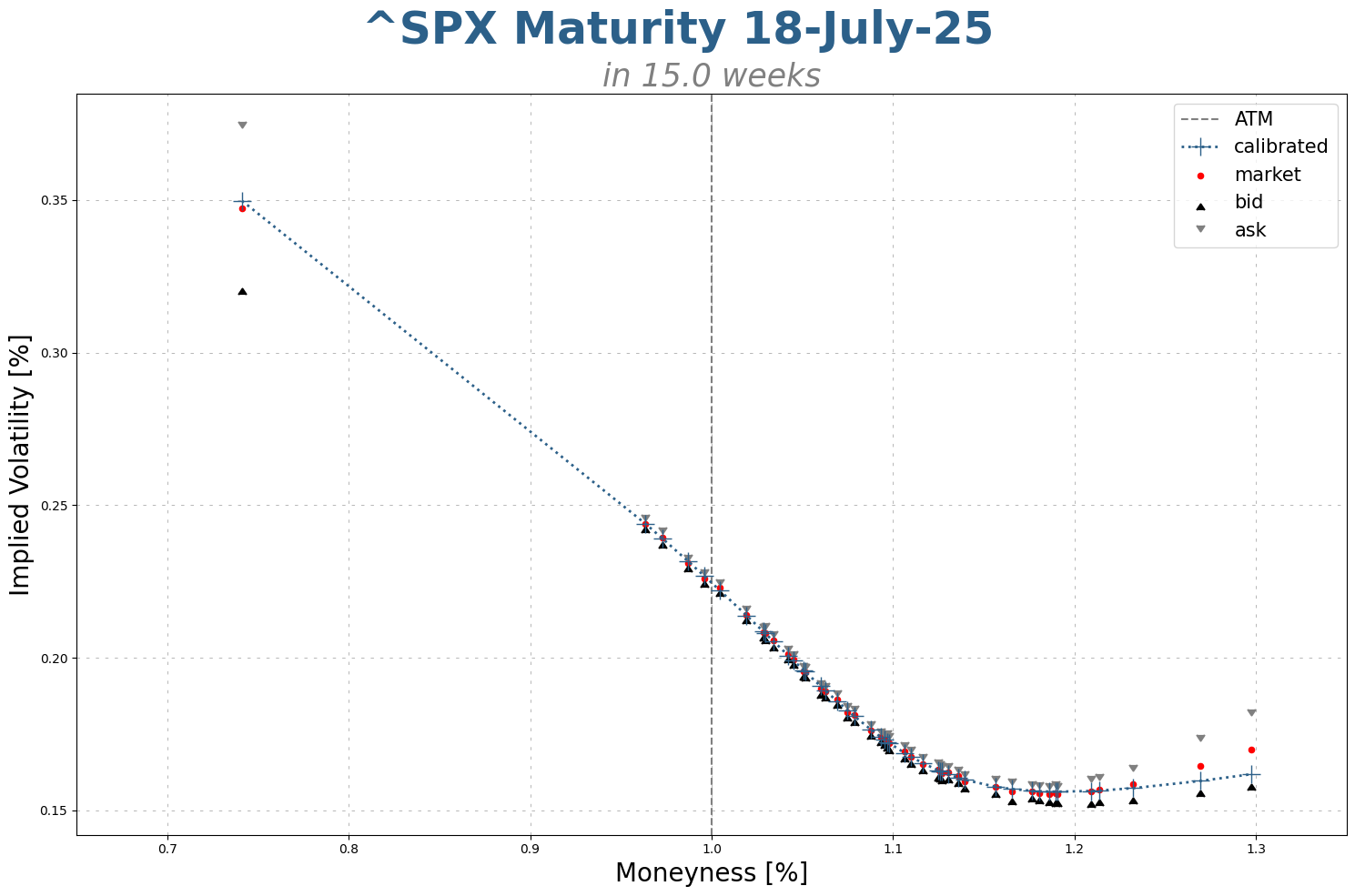

Sanity check of the data from yfinance

[9]:

time_to_maturity = full_market_data['Time to Maturity'].iloc[0]

strikes = full_market_data['Strike'].values

bid_prices = full_market_data["Bid"].values

ask_prices = full_market_data['Ask'].values

market_ivs = full_market_data['Implied Volatility'].values

market_prices = full_market_data['Call Price'].values

marketVolatilitySmile = VolatilitySmile(

strikes=strikes,

time_to_maturity=time_to_maturity,

atm=spot,

market_ivs=market_ivs,

r=r

)

marketVolatilitySmile.plot(bid_prices=bid_prices, ask_prices=ask_prices)

Hmmm it is ugly, run some filters and use the mid implied volatility to denoise the market,

\[\frac{\sigma_{bid}+\sigma_{ask}}{2}\]

[10]:

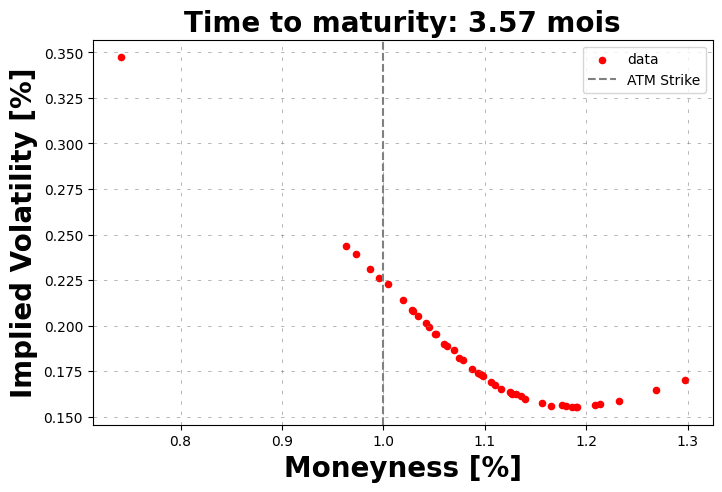

market_data = marketVolatilitySmile.filters(full_market_data)

marketVolatilitySmile.plot()

market_data.head()

[10]:

| Call Price | Bid | Ask | Implied Volatility | Strike | Volume | Time to Maturity | Maturity | Mid ivs | Ask ivs | Bid ivs | Mid Price | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 13 | 1474.75 | 1411.0 | 1426.2 | 0.377997 | 4000.0 | 731.0 | 0.297619 | 2025-07-18 | 0.347358 | 0.373705 | 0.321010 | 1418.60 |

| 39 | 429.56 | 389.0 | 391.4 | 0.247988 | 5200.0 | 40.0 | 0.297619 | 2025-07-18 | 0.243961 | 0.245046 | 0.242876 | 390.20 |

| 42 | 393.78 | 354.8 | 358.3 | 0.243847 | 5250.0 | 40.0 | 0.297619 | 2025-07-18 | 0.239403 | 0.240951 | 0.237855 | 356.55 |

| 46 | 467.57 | 305.5 | 307.8 | 0.234829 | 5325.0 | 38.0 | 0.297619 | 2025-07-18 | 0.231043 | 0.232036 | 0.230050 | 306.65 |

| 49 | 376.33 | 274.5 | 276.9 | 0.229813 | 5375.0 | 250.0 | 0.297619 | 2025-07-18 | 0.226052 | 0.227078 | 0.225026 | 275.70 |

We can now calibrate an Heston model and an Bates model on the cleaned data

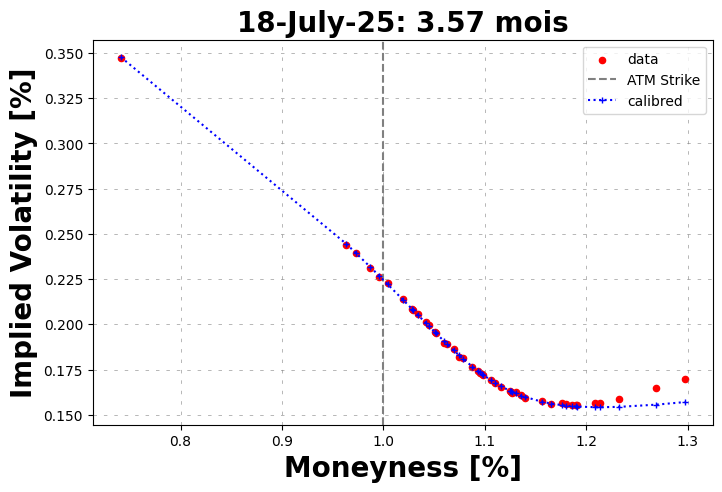

Calibration with an Heston model#

[11]:

params = {

"kappa": 1.25,

"theta": 0.06,

"sigma": 0.6,

"rho": -0.8,

}

heston = Heston(spot=spot, vol_initial=0.06, r=r, drift_emm=0, **params)

initial_params = marketVolatilitySmile.calibration(

price_function=heston.call_price,

guess_correlation_sign='negative',

initial_guess=list(params.values()),

speed='local',

)

initial_guess = [initial_params['kappa'], initial_params['theta'], initial_params['sigma'], initial_params['rho']]

calibrated_params = marketVolatilitySmile.calibration(

price_function=heston.call_price,

guess_correlation_sign='negative',

initial_guess=initial_guess,

power='mse',

speed='global',

)

marketVolatilitySmile.plot(

calibrated_prices=heston.call_price(strike=marketVolatilitySmile.strikes, time_to_maturity=time_to_maturity, **calibrated_params),

maturity=maturity

)

calibrated_params

Calibrated parameters: v0=0.051 | kappa=0.582 | theta=0.182 | sigma=0.708 | rho=-0.817

at minimum 0.180315 accepted 1

Parameters: kappa=0.582 | theta=0.182 | sigma=0.708 | rho=-0.817

at minimum 0.180315 accepted 1

Parameters: kappa=0.582 | theta=0.182 | sigma=0.708 | rho=-0.817

at minimum 0.180315 accepted 1

Parameters: kappa=0.582 | theta=0.182 | sigma=0.708 | rho=-0.817

at minimum 0.180315 accepted 1

Parameters: kappa=0.582 | theta=0.182 | sigma=0.708 | rho=-0.817

at minimum 0.180315 accepted 1

Parameters: kappa=0.582 | theta=0.182 | sigma=0.708 | rho=-0.817

at minimum 0.180315 accepted 1

Parameters: kappa=0.582 | theta=0.182 | sigma=0.708 | rho=-0.817

at minimum 0.180315 accepted 1

Parameters: kappa=0.582 | theta=0.182 | sigma=0.708 | rho=-0.817

at minimum 0.180324 accepted 1

Parameters: kappa=0.594 | theta=0.179 | sigma=0.709 | rho=-0.817

at minimum 0.180315 accepted 1

Parameters: kappa=0.582 | theta=0.182 | sigma=0.708 | rho=-0.817

at minimum 0.180315 accepted 1

Parameters: kappa=0.582 | theta=0.182 | sigma=0.708 | rho=-0.817

['success condition satisfied'] True

Calibrated parameters: v0=0.051 | kappa=0.582 | theta=0.182 | sigma=0.708 | rho=-0.817

[11]:

{'vol_initial': np.float64(0.05109935754345381),

'kappa': np.float64(0.5815576684696807),

'theta': np.float64(0.1816239411613502),

'sigma': np.float64(0.707675064288899),

'rho': np.float64(-0.8170984923714757),

'drift_emm': 0}

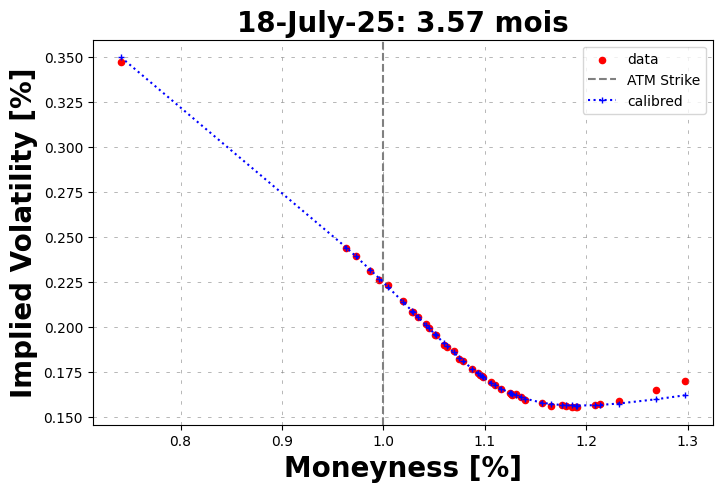

Calibration with a Baites model#

[12]:

calibrated_params

[12]:

{'vol_initial': np.float64(0.05109935754345381),

'kappa': np.float64(0.5815576684696807),

'theta': np.float64(0.1816239411613502),

'sigma': np.float64(0.707675064288899),

'rho': np.float64(-0.8170984923714757),

'drift_emm': 0}

[15]:

params = {

"kappa": 1.25,

"theta": 0.06,

"sigma": 0.6,

"rho": -0.5,

"lambda_jump": 1.0,

"mu_J": -0.1,

'sigma_J': 0.3

}

bates = Bates(spot=spot, vol_initial=0.06, r=r, drift_emm=0, **params)

initial_params = marketVolatilitySmile.calibration(

price_function=bates.call_price,

guess_correlation_sign='negative',

initial_guess=list(params.values()),

power='mse',

speed='local',

)

initial_guess = [initial_params['kappa'], initial_params['theta'], initial_params['sigma'], initial_params['rho'],

initial_params['lambda_jump'], initial_params['mu_J'], initial_params['sigma_J']]

calibrated_params = marketVolatilitySmile.calibration(

price_function=bates.call_price,

guess_correlation_sign='negative',

initial_guess=initial_guess,

power='mse',

speed='global',

)

marketVolatilitySmile.plot(

calibrated_prices=bates.call_price(strike=marketVolatilitySmile.strikes, time_to_maturity=time_to_maturity, **calibrated_params),

maturity=maturity

)

calibrated_params

Calibrated parameters:

v0=0.051 | kappa=1.170 | theta=0.086 | sigma=0.802 | rho=-0.796 | lambda_jump=0.569 | mu_J=-0.087 | sigma_J=0.050

at minimum 0.138248 accepted 1

Parameters: kappa=1.170 | theta=0.086 | sigma=0.802 | rho=-0.796 | lambda_jump=0.569 | mu_J=-0.087 | sigma_J=0.050

at minimum 0.137477 accepted 1

Parameters: kappa=1.816 | theta=0.070 | sigma=0.865 | rho=-0.786 | lambda_jump=0.509 | mu_J=-0.108 | sigma_J=0.050

at minimum 0.137710 accepted 1

Parameters: kappa=1.518 | theta=0.076 | sigma=0.836 | rho=-0.790 | lambda_jump=0.526 | mu_J=-0.099 | sigma_J=0.050

at minimum 0.137298 accepted 1

Parameters: kappa=2.585 | theta=0.060 | sigma=0.944 | rho=-0.774 | lambda_jump=0.510 | mu_J=-0.122 | sigma_J=0.050

at minimum 0.137585 accepted 1

Parameters: kappa=1.651 | theta=0.073 | sigma=0.848 | rho=-0.788 | lambda_jump=0.516 | mu_J=-0.103 | sigma_J=0.050

at minimum 0.137499 accepted 1

Parameters: kappa=1.773 | theta=0.070 | sigma=0.861 | rho=-0.786 | lambda_jump=0.510 | mu_J=-0.107 | sigma_J=0.050

at minimum 0.137303 accepted 1

Parameters: kappa=2.893 | theta=0.057 | sigma=0.977 | rho=-0.770 | lambda_jump=0.514 | mu_J=-0.126 | sigma_J=0.050

at minimum 0.177881 accepted 1

Parameters: kappa=0.002 | theta=2.682 | sigma=0.530 | rho=-0.786 | lambda_jump=0.063 | mu_J=-0.413 | sigma_J=0.050

['success condition satisfied'] True

Calibrated parameters:

v0=0.051 | kappa=2.585 | theta=0.060 | sigma=0.944 | rho=-0.774 | lambda_jump=0.510 | mu_J=-0.122 | sigma_J=0.050

[15]:

{'vol_initial': np.float64(0.05109935754345381),

'kappa': np.float64(2.5854664613188842),

'theta': np.float64(0.059849220476281995),

'drift_emm': 0,

'sigma': np.float64(0.9439656148672756),

'rho': np.float64(-0.7743390297835321),

'lambda_jump': np.float64(0.5102923508017523),

'mu_J': np.float64(-0.12185194574808611),

'sigma_J': np.float64(0.05)}

Fancy plot

[16]:

from datetime import datetime

import numpy as np

import matplotlib.pyplot as plt

import matplotlib.font_manager as font_manager

font_legend = font_manager.FontProperties(

style='normal',

size=20,

)

fontdict = {

"fontsize": 20,

# "fontweight": "bold"

}

fontdict_suptitle = {

'fontsize': 30,

'fontweight': 'bold'

}

fontdict_title = {

'fontsize': 30,

'fontweight': 'bold'

}

calibrated_prices = bates.call_price(strike=marketVolatilitySmile.strikes, time_to_maturity=time_to_maturity, **calibrated_params)

calibrated_ivs = marketVolatilitySmile.compute_smile(prices=calibrated_prices)

ask_ivs = market_data['Ask ivs'].values

bid_ivs = market_data['Bid ivs'].values

forward = marketVolatilitySmile.atm * np.exp(marketVolatilitySmile.r * marketVolatilitySmile.time_to_maturity)

plt.figure(figsize=(15, 10))

plt.axvline(1, linestyle="--", color="gray", label='ATM')

plt.plot(marketVolatilitySmile.strikes / forward, calibrated_ivs, marker='+', color='#2c6089', linestyle="dotted", markersize=14, linewidth=2, label='calibrated')

plt.scatter(marketVolatilitySmile.strikes / forward, marketVolatilitySmile.market_ivs, marker='o', color='red', s=20, label='market')

plt.scatter(marketVolatilitySmile.strikes / forward, bid_ivs, marker=6, color='black', s=40, label='bid')

plt.scatter(marketVolatilitySmile.strikes / forward, ask_ivs, marker=7, color='gray', s=40, label='ask')

plt.xlabel("Moneyness [%]", fontdict=fontdict)

plt.ylabel("Implied Volatility [%]", fontdict=fontdict)

plt.xlim((0.65, 1.35))

date = datetime.strptime(maturity, '%Y-%m-%d').date().strftime("%d-%B-%y")

title = f"{symbol} Maturity {date}"

plt.suptitle(title, fontsize=35, fontweight='bold', color='#2c6089')

plt.title(f"in {marketVolatilitySmile.time_to_maturity * 252 / 5:.1f} weeks", color="grey", style='italic', fontsize=25)

plt.grid(visible=True, which="major", linestyle="--", dashes=(5, 10), color="gray", linewidth=0.5, alpha=0.8)

plt.legend(fontsize=15)

plt.tight_layout()

plt.show()