Hedging with Black-Scholes#

[2]:

import numpy as np

import matplotlib.pyplot as plt

from hestonpy.models.blackScholes import BlackScholes

import pandas as pd

dates = pd.date_range(start="2025-01-01", end="2025-07-01", freq="D")

nbr_simulations = 1000

nbr_hedges = len(dates)-1

Replication errors#

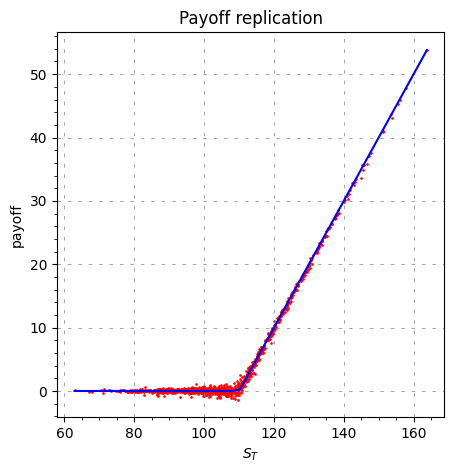

Sanity check of the replication

[3]:

real_vol = 0.15

hedging_vol = 0.15

bs = BlackScholes(

spot=100, r=0.01, mu=0.05, volatility=real_vol)

strike = 110

res = bs.delta_hedging(

flag_option="call",

time_to_maturity=1,

strike=strike,

hedging_volatility=hedging_vol,

pricing_volatility=hedging_vol,

nbr_simulations=nbr_simulations,

nbr_hedges=nbr_hedges,

)

portfolio = res[0]

S = res[1]

ST = S[:, -1]

VT = portfolio[:, -1]

plt.figure(figsize=(5, 5))

plt.title("Payoff replication")

plt.grid(linestyle="--", dashes=(5, 10), color="gray", linewidth=0.5)

plt.minorticks_on()

plt.xlabel(r"$S_T$")

plt.ylabel("payoff")

plt.scatter(ST, VT, s=0.8, color="red")

x = np.linspace(min(ST), max(ST))

payoff = np.maximum(0, x - strike)

plt.plot(x, payoff, color="blue")

plt.show()

Sanity check of the replicationCheck the replication errors

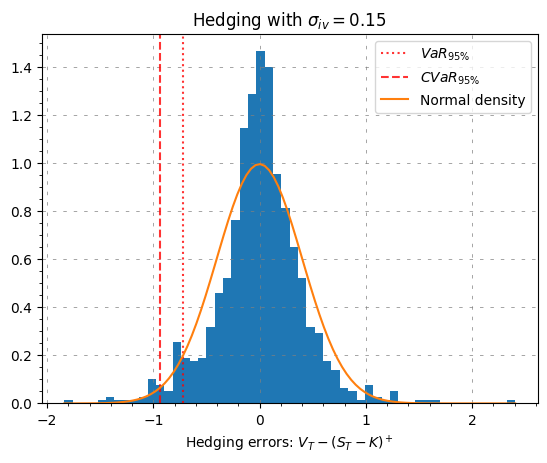

[4]:

from scipy.stats import norm

cash_flows = np.maximum(0, ST - strike)

hedging_errors = VT - cash_flows

hedging_errors = np.sort(hedging_errors)

VaR95_index = int(0.05 * len(hedging_errors))

VaR95 = hedging_errors[VaR95_index]

CVaR95 = np.mean(hedging_errors[:VaR95_index])

plt.figure()

plt.title("Hedging with " + r"$\sigma_{iv} = $" + str(hedging_vol))

plt.hist(hedging_errors, bins="fd", density=True)

plt.axvline(VaR95, color='red', label=r'$VaR_{95\%}$', linestyle="dotted",alpha=0.8)

plt.axvline(CVaR95, color='red', label=r'$CVaR_{95\%}$', linestyle="--", alpha=0.8)

x = np.linspace(start=min(hedging_errors), stop=max(hedging_errors), num=100)

plt.plot(

x,

norm.pdf(x, loc=np.mean(hedging_errors), scale=np.std(hedging_errors)),

label="Normal density",

)

plt.grid(linestyle="--", dashes=(5, 10), color="gray", linewidth=0.5)

plt.minorticks_on()

plt.xlabel(r"Hedging errors: $V_T - (S_T - K)^+$")

plt.legend()

plt.show()

Looks like the hedging errors are fat tailed fat tailed

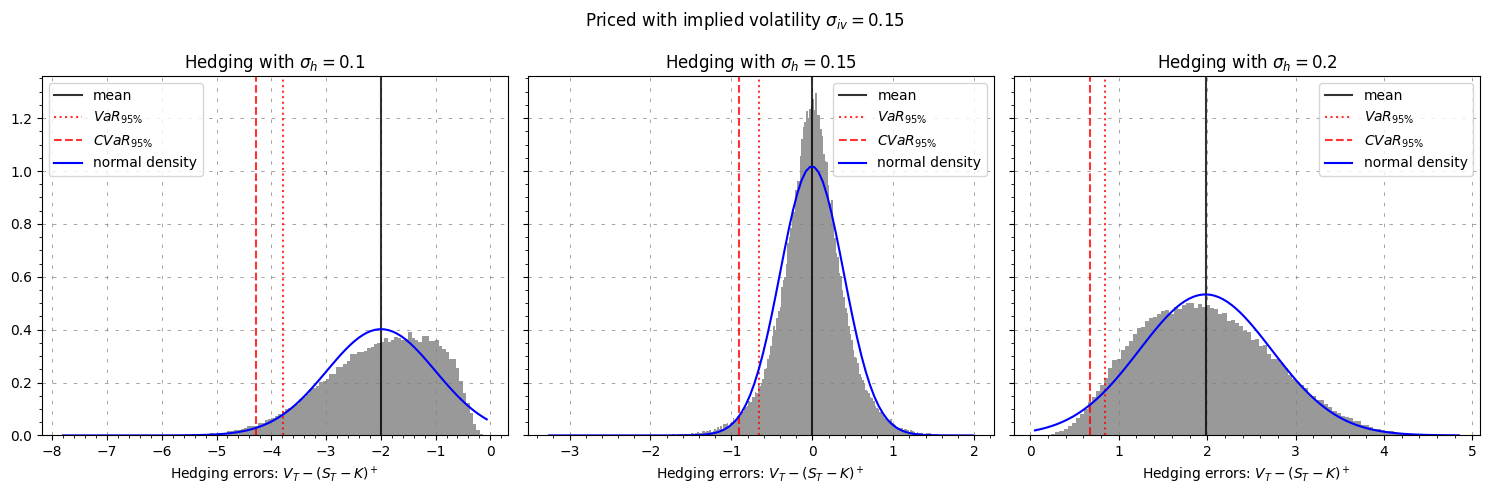

Hedging with different volatilities#

We analyse what is happening when we hedge with different volatilities (w.r.t to the pricing volatilities)

[5]:

implied_volatility = 0.15

hedging_vols = [0.10, 0.15, 0.20]

bs = BlackScholes(spot=100, r=0.00, mu=0.00, volatility=implied_volatility)

strike = 100

nbr_simulations = 100000

fig, axes = plt.subplots(1, 3, figsize=(15, 5), sharey=True)

for i, vol in enumerate(hedging_vols):

res = bs.delta_hedging(

flag_option="call",

time_to_maturity=1,

strike=strike,

hedging_volatility=vol,

nbr_simulations=nbr_simulations,

nbr_hedges=nbr_hedges,

)

portfolio = res[0]

S = res[1]

ST = S[:, -1]

VT = portfolio[:, -1]

cash_flows = np.maximum(0, ST - strike)

hedging_errors = VT - cash_flows

hedging_errors = np.sort(hedging_errors)

VaR95_index = int(0.05 * len(hedging_errors))

VaR95 = hedging_errors[VaR95_index]

CVaR95 = np.mean(hedging_errors[:VaR95_index])

axes[i].set_title("Hedging with " + r"$\sigma_{h} = $" + str(vol))

axes[i].hist(hedging_errors, bins="fd", density=True, color="gray", alpha=0.8)

axes[i].axvline(np.mean(hedging_errors), color="black", label="mean", alpha=0.8)

axes[i].axvline(VaR95, color='red', label=r'$VaR_{95\%}$', linestyle="dotted",alpha=0.8)

axes[i].axvline(CVaR95, color='red', label=r'$CVaR_{95\%}$', linestyle="--", alpha=0.8)

x = np.linspace(start=min(hedging_errors), stop=max(hedging_errors), num=100)

axes[i].plot(

x,

norm.pdf(x, loc=np.mean(hedging_errors), scale=np.std(hedging_errors)),

label="normal density",

color="blue",

)

axes[i].grid(linestyle="--", dashes=(5, 10), color="gray", linewidth=0.5)

axes[i].minorticks_on()

axes[i].set_xlabel(r"Hedging errors: $V_T - (S_T - K)^+$")

axes[i].legend()

plt.suptitle(

r"Priced with implied volatility $\sigma_{iv} =$" + str(implied_volatility)

)

plt.tight_layout()

plt.show()

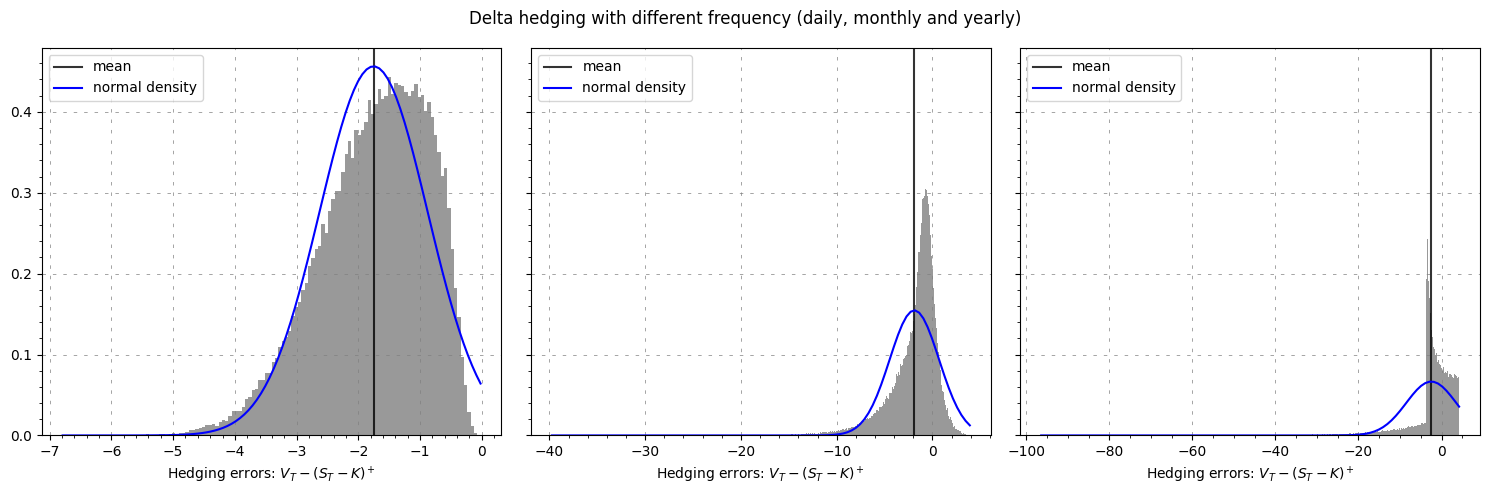

Hedging at different frequencies#

We analyse what is happening when we hedge daily, monthly or yearly

[6]:

implied_volatility = 0.15

bs = BlackScholes(spot=100, r=0.00, mu=0.00, volatility=implied_volatility)

strike = 100

daily_dates = pd.date_range(start="2025-01-01", end="2025-07-01", freq="D")

monthly_dates = pd.date_range(start="2025-01-01", end="2025-07-01", freq="ME")

yearly_dates = [daily_dates[0]]

fig, axes = plt.subplots(1, 3, figsize=(15, 5), sharey=True)

for i, dates in enumerate([daily_dates, monthly_dates, yearly_dates]):

res = bs.delta_hedging(

flag_option="call",

time_to_maturity=0.5,

strike=strike,

hedging_volatility=implied_volatility,

nbr_simulations=nbr_simulations,

nbr_hedges=len(dates),

)

portfolio = res[0]

S = res[1]

ST = S[:, -1]

VT = portfolio[:, -1]

cash_flows = np.maximum(0, ST - strike)

hedging_errors = VT - cash_flows

hedging_errors = np.sort(hedging_errors)

axes[i].hist(hedging_errors, bins="fd", density=True, color="gray", alpha=0.8)

axes[i].axvline(np.mean(hedging_errors), color="black", label="mean", alpha=0.8)

x = np.linspace(start=min(hedging_errors), stop=max(hedging_errors), num=100)

axes[i].plot(

x,

norm.pdf(x, loc=np.mean(hedging_errors), scale=np.std(hedging_errors)),

label="normal density",

color="blue",

)

axes[i].grid(linestyle="--", dashes=(5, 10), color="gray", linewidth=0.5)

axes[i].minorticks_on()

axes[i].set_xlabel(r"Hedging errors: $V_T - (S_T - K)^+$")

axes[i].legend()

plt.suptitle("Delta hedging with different frequency (daily, monthly and yearly)")

plt.tight_layout()

plt.show()

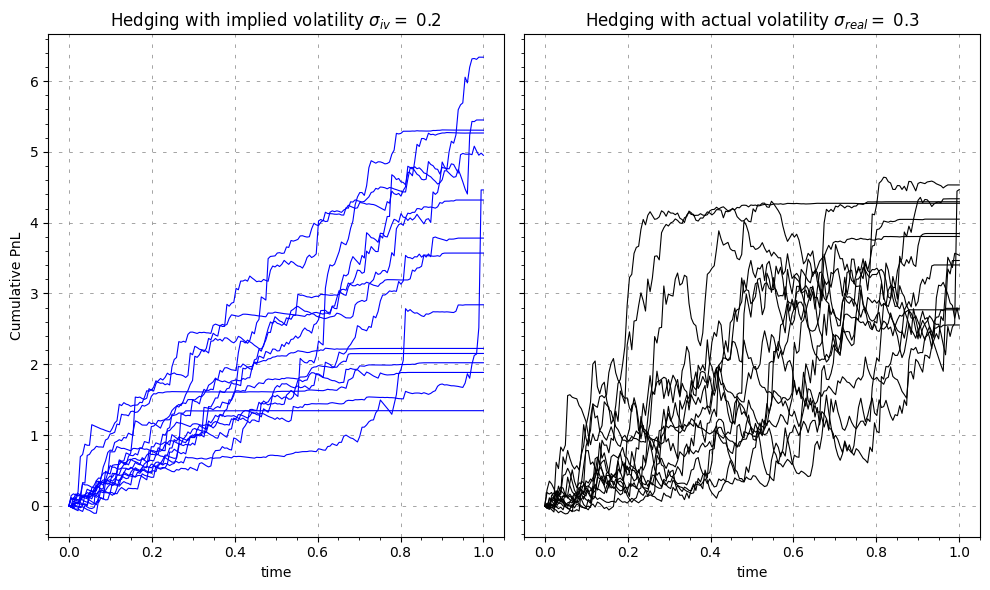

Hedging with a misspecified model#

Since the market does not have perfect knowledge about the future actual and implied volatilities can and will be different.

Imagine that we have a forecast for volatility over the remaining life of an option, this volatility is forecast to be constant, and further assume that our forecast turns out to be correct. We shall buy an underpriced option and delta hedge to expiry.But which delta do you choose? Delta based on actual or implied volatility?

Scenario: Implied volatility for an option is 20%, but we believe that actual volatility is 30%.

Question: How can we make money if our forecast is correct?

Answer: Buy the option and delta hedge. But which delta do we use?

[7]:

np.random.seed(42)

# Model parameters

S0 = 100

mu = 0.00

r = 0.00

time_to_maturity = 1

stirke = 100

real_volatility = 0.30

implied_volatility = 0.20

model = BlackScholes(spot=100, r=r, mu=mu, volatility=real_volatility)

portfolio_iv, _ = model.volatility_arbitrage(

pricing_volatility=implied_volatility,

hedging_volatility=implied_volatility,

strike=strike,

time_to_maturity=time_to_maturity,

flag_option="call",

nbr_hedges=nbr_hedges,

nbr_simulations=nbr_simulations,

)

portfolio_real, _ = model.volatility_arbitrage(

pricing_volatility=implied_volatility,

hedging_volatility=real_volatility,

strike=strike,

time_to_maturity=time_to_maturity,

flag_option="call",

nbr_hedges=nbr_hedges,

nbr_simulations=nbr_simulations,

)

Plot the porfolio path simulations

[8]:

number_plots = 15 # must be < nPaths

# Plotting results

fig, (ax1, ax2) = plt.subplots(1, 2, figsize=(10, 6), sharey=True)

time_points = np.linspace(0, 1, nbr_hedges + 1)

# Hedging with actual volatility

ax1.set_title(

"Hedging with implied volatility " + r"$\sigma_{iv} =$ " + str(implied_volatility)

)

for i in range(number_plots):

ax1.plot(

time_points, portfolio_iv[i, :], color="blue", linewidth=0.8

) # Add transparency for better readability

ax1.grid(linestyle="--", dashes=(5, 10), color="gray", linewidth=0.5)

ax1.minorticks_on()

ax1.set_xlabel("time")

ax1.set_ylabel("Cumulative PnL")

# Hedging with implied volatility

ax2.set_title(

"Hedging with actual volatility " + r"$\sigma_{real} =$ " + str(real_volatility)

)

for i in range(number_plots):

ax2.plot(

time_points, portfolio_real[i, :], color="black", linewidth=0.8

) # Add transparency for better readability

ax2.grid(linestyle="--", dashes=(5, 10), color="gray", linewidth=0.5)

ax2.minorticks_on()

ax2.set_xlabel("time")

plt.tight_layout()

plt.show()

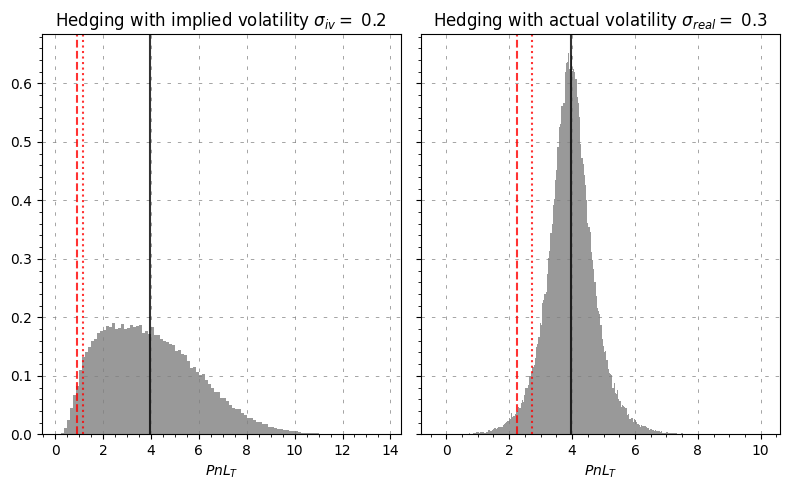

Plot the distribution of the portfolio returns

[11]:

fig, (ax1, ax2) = plt.subplots(1, 2, figsize=(8, 5), sharey=True)

ax1.set_title(

"Hedging with implied volatility " + r"$\sigma_{iv} =$ " + str(implied_volatility)

)

final_pnl_iv = portfolio_iv[:, -1]

final_pnl_iv = np.sort(final_pnl_iv)

VaR95_index = int(0.05 * len(final_pnl_iv))

VaR95 = final_pnl_iv[VaR95_index]

CVaR95 = np.mean(final_pnl_iv[:VaR95_index])

ax1.axvline(np.mean(final_pnl_iv), color="black", label="mean", alpha=0.8)

ax1.axvline(VaR95, color='red', label=r'$VaR_{95\%}$', linestyle="dotted",alpha=0.8)

ax1.axvline(CVaR95, color='red', label=r'$CVaR_{95\%}$', linestyle="--", alpha=0.8)

ax1.hist(final_pnl_iv, bins="fd", density=True, color="gray", alpha=0.8)

ax1.grid(linestyle="--", dashes=(5, 10), color="gray", linewidth=0.5)

ax1.minorticks_on()

ax1.set_xlabel("$PnL_T$")

ax2.set_title(

"Hedging with actual volatility " + r"$\sigma_{real} =$ " + str(real_volatility)

)

final_pnl_actual = portfolio_real[:, -1]

final_pnl_actual = np.sort(final_pnl_actual)

VaR95_index = int(0.05 * len(final_pnl_actual))

VaR95 = final_pnl_actual[VaR95_index]

CVaR95 = np.mean(final_pnl_actual[:VaR95_index])

ax2.axvline(np.mean(final_pnl_actual), color="black", label="mean", alpha=0.8)

ax2.axvline(VaR95, color='red', label=r'$VaR_{95\%}$', linestyle="dotted",alpha=0.8)

ax2.axvline(CVaR95, color='red', label=r'$CVaR_{95\%}$', linestyle="--", alpha=0.8)

ax2.hist(final_pnl_actual, bins="fd", density=True, color="gray", alpha=0.8)

ax2.grid(linestyle="--", dashes=(5, 10), color="gray", linewidth=0.5)

ax2.minorticks_on()

ax2.set_xlabel("$PnL_T$")

plt.tight_layout()

plt.show()

Some statistics about the two portfolio

[10]:

# Statistics

# Hedging with implied volatility

final_pnl = portfolio_iv[:, -1]

mean_pnl = np.mean(final_pnl)

std_pnl = np.std(final_pnl)

pathwise_var = np.mean([np.sum(np.diff(portfolio_iv[i]) ** 2) for i in range(nbr_simulations)])

print(f"Experiment 1 (blue) - Hedging with implied volatility:")

print(f" Mean PnL(T): {mean_pnl:.2f}")

print(f" Std Dev PnL(T): {std_pnl:.2f}")

print(f" Pathwise Quadratic Variation: {pathwise_var:.2f}\n")

# Hedging with actual/forecasted volatility

final_pnl = portfolio_real[:, -1]

mean_pnl = np.mean(final_pnl)

std_pnl = np.std(final_pnl)

pathwise_var = np.mean([np.sum(np.diff(portfolio_real[i]) ** 2) for i in range(nbr_simulations)])

print(f"Experiment 2 (black) - Hedging with actual/forecasted volatility:")

print(f" Mean PnL(T): {mean_pnl:.2f}")

print(f" Std Dev PnL(T): {std_pnl:.2f}")

print(f" Pathwise Quadratic Variation: {pathwise_var:.2f}\n")

Experiment 1 (blue) - Hedging with implied volatility:

Mean PnL(T): 3.96

Std Dev PnL(T): 1.99

Pathwise Quadratic Variation: 1.13

Experiment 2 (black) - Hedging with actual/forecasted volatility:

Mean PnL(T): 3.96

Std Dev PnL(T): 0.78

Pathwise Quadratic Variation: 4.23