hestonpy: Calibration of stochastic volatility models#

hestonpy

Stochastic Volatility models

hestonpy implements Heston and Bates models for options pricing,

hedging, and robust calibration on implied volatility smiles.

Key features#

It is an user friendly, intuitive and humble python library. Please, contact me if you have any suggestions! :)

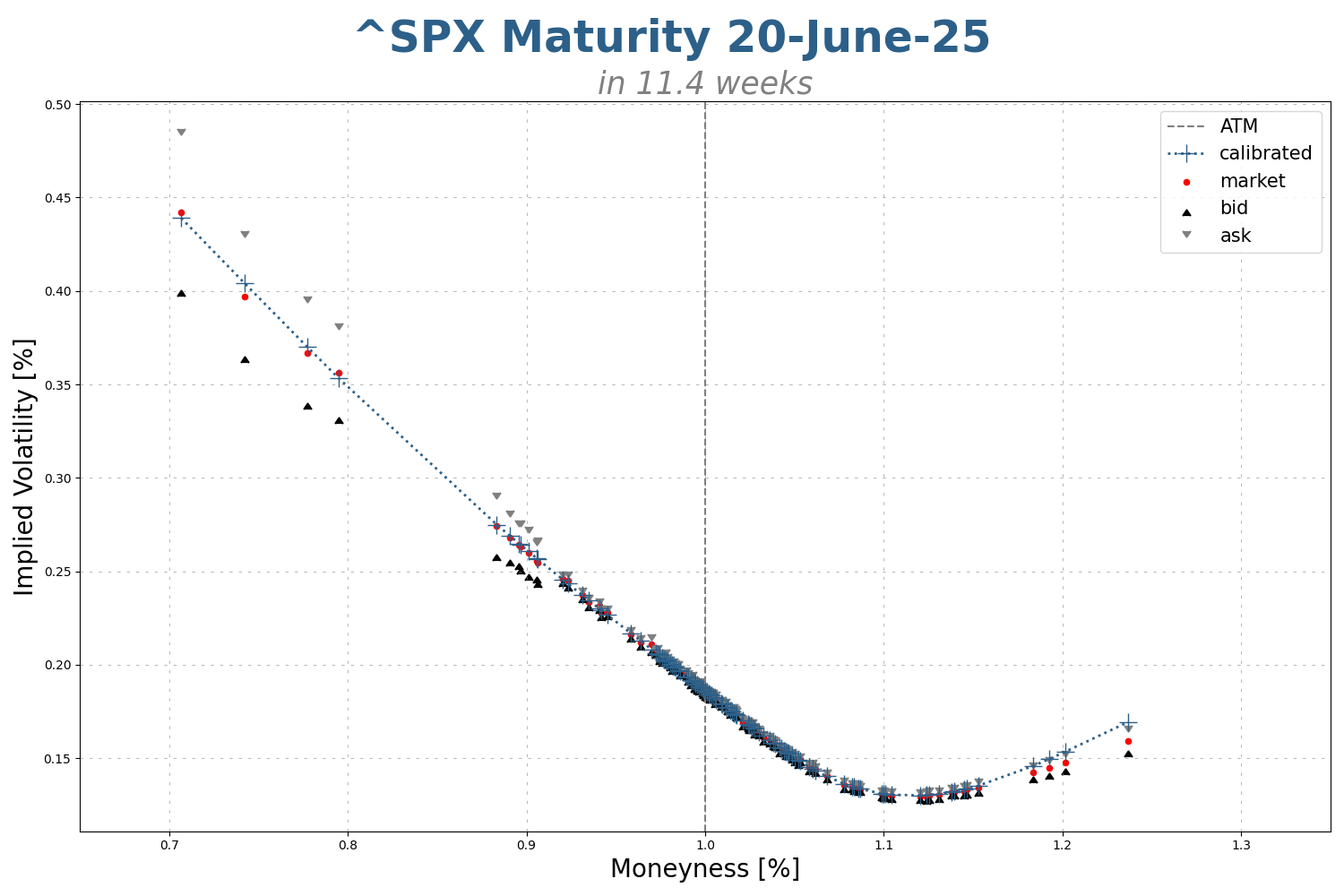

The hestonpy Python package implements the Heston and Bates models for option pricing, hedging,

and robust calibration on implied volatility smiles.

The package also includes functionality for optimal portfolio allocation using stochastic control techniques.

Covered topics by the hestonpy package:

Heston, Bates, and Black-Scholes models (vanilla options pricing, hedging).

Calibration on implied volatility smile (from Yahoo Finance data, personal data, or synthetic data).

De-noising market data (SVI implementation and filters).

Asset allocations (stochastic optimal control under Heston dynamics).